The American Legacy Foundation is a rare example of a public charity being born with a silver spoon. Even before it began operating in 1999, the foundation was bequeathed more than $1 billion from the settlement of a massive lawsuit brought by the attorneys general of 46 states against the country’s major tobacco companies. That money is part of billions of dollars that the tobacco companies paid, basically as reparations, for the damage their products wreaked on the public.

|

|

Washington National Opera |

The foundation was conceived as an antidote to that past. Tasked to target teen smoking, its mandated anti-tobacco campaigns were seen as the best way to prevent a heavy tobacco-related health toll in the future.

For the first few years, it seemed a great success. The foundation rolled out hard-hitting and ubiquitous advertising, known as “the truth” campaign. Perhaps the most famous ad, broadcast repeatedly during the 2000 Olympics, had an urban guerilla bent, with workers emptying trucks of 1,200 body bags and dumping them outside the headquarters of Philip Morris in New York, representing the number of Americans who die each day because of tobacco use.

On the heels of this and other anti-tobacco efforts, teen smoking dropped from 36 percent in 1997, a year before the tobacco case settlement, to below 22 percent in 2003. American Legacy was given much of the credit – and continues to cite the statistic – although the smoking rate overall had been going downhill since the first U.S. surgeon general’s warning about smoking in the 1960s. There were heady predictions of a tobacco-free generation resulting from the foundation’s efforts.

|

Anti-tobacco commercials |

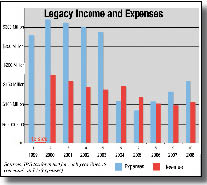

Then the magic stopped working so well. Since 2003, teen smoking rates have hovered around 22 percent, even as adult smoking has continued to dwindle (to under 20 percent now). After the final really big tobacco payment of $307.9 million came that year (under the Master Settlement), “the truth” campaign continued on a much smaller scale.

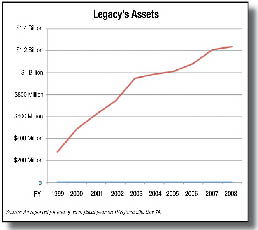

But despite spending less on those ads, awarding fewer grants for anti-smoking programs and seeing all the tobacco company contributions end last year, the foundation itself grew wealthier. As expenditures for its primary missions fell, two budget items kept growing: investment fees and salary costs, especially for top executives.

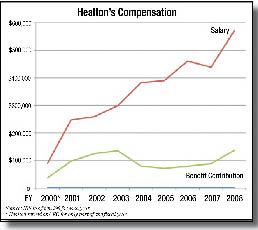

President and CEO Cheryl Healton came on board in 2000 from Columbia University’s School of Public Health at an annual salary of about $246,700. By 2008, her pay had more than doubled, to $570,000 in base salary and more than $137,000 in benefit contributions, according to the organization’s federal tax returns. The foundation’s total salary costs consumed more than 10 percent of its annual budget in fiscal 2007 and 2008. (Fiscal 2008 ended June 30, 2008, and is the latest period for which financial documents are available.)

|

As for investments, foundation leaders decided at its inception that rather than spend all the money as it came in, they would spend about half and invest the rest as a way to lengthen the foundation’s life. “We have saved each year into a reserve fund,” Healton told Youth Today, “and we plan to use that to continue to help youths make the right decision about smoking.”

While most nonprofits invest to protect their funds, the Legacy Foundation has pursued an aggressive investment strategy that includes hedge funds, foreign stocks (sometimes accompanied by currency exchange losses), interest rate swaps, two office buildings in downtown Washington and other investments.

Some observers say Legacy is trying too hard to perpetuate itself and the cause would be better served if it spent more of its endowment, which stood at $1.156 billion at the end of fiscal 2008.

|

|

The American Legacy Foundation says President Cheryl Healton’s salary of $570,000 in 2008 (plus benefits) is about the same as the median for others in large philanthropic endeavors. The Council of Foundation’s annual salary survey shows that the median salary for the head of a private foundation with assets of more than $1 billion is $451,391, ranging from $250,000 to $675,000. (Legacy listed $1.2 billion in assets for 2008.) The survey reflects salaries as of Feb. 1, 2008. However, the IRS has ruled that American Legacy Foundation is a actually public charity because of the amount of money it received from governments under the Master Settlement Agreement. No information is available about the median salaries at such institutions. The highest paid person listed on the 2007 tax forms (fiscal 2008) of the American National Red Cross is the general counsel and secretary, who made $466,371. The Red Cross reported $2.6 billion in assets that year, and expenses of $3.66 billion.

|

“When they were formed, nobody said they had to be here in perpetuity,” said a former anti-tobacco activist, who asked not to be named. “But that’s what they’ve done. They’re a public charity, but they’re using something similar to the 5-percent-payout model, like a [private] foundation.”

Legacy’s defenders counter that spending all the money wouldn’t be the best way to fulfill the organization’s mission. “Smoking has been around for over 100 years. It won’t go away in 10,” said Gregory Connolly, professor of public health practice at Harvard University, and formerly the director of tobacco control programs in Massachusetts.

“Going against the tobacco industry is a marathon and not a sprint,” Healton said.

Legacy’s Mandate

The idea for the American Legacy Foundation sprang from a program called Truth that the state of Florida ran as part of its anti-smoking program, which was financed by its own tobacco suit settlement in 1997. Headed by Chuck Wolfe, Truth ran a $65 million media campaign and spent the same amount on peer-to-peer programs.

Wolfe believed that youth activists had to be involved in the design of government programs to discourage smoking, rather than be preached at from a lofty perch. It was the youth in Florida’s program who turned facts that had emerged during various tobacco lawsuit trials back on the tobacco companies.

An early ad featured youths who taped their phone calls to an official of a fictitious tobacco company called “Lucky Strike,” asking what was lucky about it. “Is it that you might live?”

The 1998 Master Settlement spelled out the work to be done by what was then known as the MSA National Foundation. First among its charges: “carrying out a nationwide sustained advertising and education program to (A) counter the use by Youth of Tobacco Products, and (B) educate consumers about the cause and prevention of diseases associated with the use of Tobacco Products.”

|

|

National Symphony Orchestra |

The MSA went on to dictate 10 other duties of the foundation. Two concern how the tobacco company payments were to be handled. Six prominently specify that the foundation’s work was to be dedicated to “Youth.” Another refers to parents, and the other concerns cessation programs.

In response to questions, Julia Cartwright, senior vice president for communications, said via e-mail, “The language of the Master Settlement Agreement (MSA) that created Legacy not only does not mandate that the organization focus on youth, it requires us to have a broader focus.” Then in bold type, the e-mail stated, “We ask that Youth Today compare us with other nonprofits of the same size and scope, and not identify us as a solely youth-focused organization.”

|

Anti-tobacco commericals

|

Wolfe, who relied heavily on youth in the Florida campaign, was hired as the executive vice president and chief operating officer of the new foundation, and was directed to develop a similar national truth campaign. But he left the foundation not long after the arrival in 2000 of Healton, who quickly seemed to steer the foundation down a path more cerebral than merely putting out clever, gutsy ads aimed at getting youth not to smoke. The foundation began contributing to more social events.

Who Gets the Money

|

|

HQ: Legacy bought this building, which houses it’s headquarters. |

Expenditures during the next several years illustrate the changing focus. [Related story, Who Gets Legacy’s Grants]

Fiscal 2001: Spending on the anti-smoking advertising campaign topped out in fiscal 2001, which ended June 30, 2001, at $125.4 million.

That was the first year the foundation sponsored events and projects, for a total of $5.5 million. Most of the money, $4.7 million, went to the University of California, San Francisco, which houses and makes available for public view the millions of pages of tobacco company documents made public through various tobacco lawsuits (state, federal and the group of attorneys general), videos of the tobacco industry’s ads spanning four decades and even a nonsmoking dining guide for the country. There was a $100 contribution to the Central Park Conservancy and $2,500 to the Metropolitan Museum of Art.

|

|

Avalon Theatre |

Fiscal 2002: Grants more than doubled from fiscal 2001 to fiscal 2002, climbing from $11.1 million to $22.87 million. Most of the foundation’s grants go to state government departments for allocation to local organizations and to groups that serve minorities and the gay, lesbian, bisexual and transgender population.

Sponsorships that year totaled $5.15 million.

|

|

New York Botanical Garden |

Fiscal 2003: Grants peaked at $32 million. Spending for the advertising campaign fell to $75.8 million from $93.3 million a year earlier.

Of the $4.3 million in sponsorship and contributions, $3.3 million went to the University of California, San Francisco Foundation, but American Legacy Foundation expanded the range of groups to which it contributed. The contributions included $85 to the Central Park Conservancy, $50,000 to Washington’s Kennedy Center for its annual opening gala, $2,500 to the Metropolitan Museum of Art, $25,000 for the annual awards dinner of the National Center of Addiction & Substance Abuse Prevention (headed by former U.S. Health, Education and Welfare secretary Joseph Califano), $150,000 to Northrop Grumman and $240,000 to Time Inc.

The foundation lent Healton almost $1 million to buy a $975,000 house. (See related story.)

|

|

For Rent: Legacy bought this building, now rents it out. Photo: John Kelly |

The foundation, which had been renting its offices, purchased a building in downtown Washington to serve as its headquarters and to provide rental income. The foundation paid $32.25 million for a multistory building in the city’s upscale business district, which also housed the National Association of Attorneys General. Five years later, the foundation purchased a second building, along Washington’s Embassy Row, for $20 million and moved its headquarters there, retaining the first building as rental property.

The last large jumbo payment by the tobacco companies came in March 2003, and at mid-year, foundation officials told Youth Today that the foundation would be trimming its annual budget. (See “As $300m Disappears, Legacy Glides Off its Financial Cliff” at http://www.youthtoday.org)

Fiscal 2004: Despite the drop in funding, the foundation’s budget grew to $146.7 million, its highest. The amount spent on “the truth” campaign rose slightly, to $84.5 million. Sponsorships and contributions dropped to less than $1 million. There were no payments to the University of California.

|

At the same time, the foundation started a pattern of sponsoring award galas for various organizations. Califano’s CASA got $25,000 again for its award dinner. The Congressional Hispanic Caucus got $5,000 for its dinner. Five thousand dollars went to the Boys & Girls Clubs of Greater Washington’s congressional dinner; $10,000 to the Friends of the National Library of Medicine for a dinner to honor Dr. C. Everett Koop, President Ronald Reagan’s surgeon general; $10,000 for the Kennedy Center annual gala and $53,000 for the Kennedy Center Honors gala and support of its Millennium Stage; $40,000 to sponsor a breakfast for the New York Women’s Agenda; $13,000 for a table and a journal ad with the Ad Council Inc.; $25,000 to co-sponsor the Women’s Leadership Fund’s EPIC awards; and $25,000 to sponsor the anniversary gala of Women’s Policy Inc.

Fiscal 2005: The budget dropped to $120 million, with the anti-smoking ad campaign getting $64.9 million. As the budgets for advertising fell, the ad campaign won lots of creativity awards for the companies that produced them, but failed to generate as much buzz. And as the ads’ production values rose (“Why Don’t We All Focus on the Positive” is a two-minute mini-musical), the assaults on mass sensibilities morphed into more subtle challenges of corporate ethics. such as spoof, “Do You Have What It Takes to be a Tobacco Exec?”

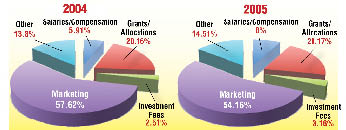

(For a more complete rundown of the foundation’s annual budget and spending, see the pie charts on these pages.)

|

|

The truth campaign’s body bag commercial became famous. |

How Legacy Invests

Almost from its founding, the foundation has carried out an ambitious – some might describe it as risky – style of financial management. The foundation manages its funds much as a large corporation might, investing in hedge funds, arranging interest rate swaps and constantly moving money around. It also financed its Massachusetts Avenue headquarters with $28 million in Washington, D.C., variable revenue bonds, which The New York Times recently cited as creating problems for nonprofits when investments and contributions fell.

In fiscal 2000 (ending June 30, 2000), the foundation had total assets of $486.7 million but sold $1.73 billion in securities, according to its tax returns.

[Related story, Who Has Oversight of Legacy?]In 2003, when its assets totaled $986.3 million, the foundation sold $8.6 billion in securities, according to that year’s returns.

Several nonprofit financial experts contacted by Youth Today – none of whom wanted to be quoted – questioned about the securities transactions listed on the tax returns suggested the amount of securities sold must have been a mistake. Generally, charities and foundations sell only a small portion of their securities in a given year, not several times the total amount of their assets.

Asked about the figures, foundation officials said Legacy was not “churning” its accounts –a term used when a broker makes excessive sales and purchases in an account to generate commissions – but that the sales represented “sound financial management to meet the foundation’s considerable cash needs over time.”

The e-mail also said: “Almost all of this … is due to ‘repo agreements’ (overnight commercial paper transactions) and other short-term commercial paper transactions, entered into through our cash (and not investment) accounts and which are designed to meet our operating cash needs.”

Here is one comparison:

At the end of fiscal 2008 (ending June 30, 2008), the American Cancer Society reported assets of $516 million and total securities sales of $356 million.

For the same tax period, the American Legacy Foundation reported assets of $1.156 billion, and sold securities worth a total of $5.6 billion.

The foundation operates as an aggressive business in another way as well: As this story was being completed, Legacy asked its communications agency to find out if Youth Today has ever accepted tobacco advertising. Publisher Bill Treanor said no.

|

Recession Impact

This year – the first in which the foundation received no tobacco money – Legacy looked to investment income as its main source of funds. But the stock markets plummeted and have yet to fully recover.

The New York Times reported last month that several Ivy League colleges that have diversified investments in similar fashion to the foundation – including swaps, hedge funds and using bonds to fund buildings – had lost more than one-fifth of their assets in the past year. For example, Yale University, which pioneered the investment strategy, reported an investment loss of 24.6 percent, compared with an average drop of 17.2 percent for large funds, according to the Wilshire Trust Universe Comparison Service. (See “University Funds Report Steep Investment Losses” at http://www.newyorktimes.com.)

Earlier this summer, foundation officials told Youth Today that assets had fallen to about $785 million. When asked to confirm that figure last month, officials questioned where it had come from.

Similarly, foundation officials said earlier this summer that the decline in assets required laying off 20 percent of its 100 employees. Asked to confirm those numbers last month, Cartwright said the foundation has 92 full-time employees and eight part-time employees, has cut 12 vacant positions through attrition and expects to phase out five more.

Foundation officials were adamant that their management methods had resulted in returns that beat the S&P 500 Index. That index dropped 47 percent between June 30, 2008, and March 5, 2009, but has since made up about half the loss.

[Related story, Healton: An Ex-Smoker Sees Hope]Asked to divulge the nature and type of the investments listed on the financial document as “inflation hedging,” the foundation said, “These were investments to manage the potential risk of inflation. Again, these are common and appropriate investments for a corpus the size of Legacy’s reserve funds.”

The officials staunchly defended their investment in hedge funds and private equities – two categories of investments that took especially heavy hits over the past year: “We have invested in hedge funds for the same reasons that many large investors invest in these funds: to reduce risk due to volatility in the markets.”

Legacy now hopes it can tap its endowment annually for $46 million, officials said during the summer.

To supplement that, the foundation has turned to fundraising, garnering a total of $4.2 million from the American Cancer Society, the American Lung Association, the Robert Wood Johnson Foundation and others. It uses grants from the federal Centers for Disease Control and Prevention to reach youth in rural areas where the truth campaign media blitzes have little presence. Legacy is also matching contributions in 17 states to develop a bilingual campaign and other programs for EX, its cessation program for adults.

The foundation is phasing out its grant program for small innovative programs, for anti-smoking programs in rural areas and among minority groups, and for research. It has spent about $150 million on these grants during its existence.

As for media strategies: Despite embracing social media such as Facebook and YouTube, the ubiquity of the foundation’s ads has faded. None has gone viral on the Web. The foundation has attracted fewer than 200 Facebook fans.

Meanwhile, tobacco companies lay out about $41 million a day for advertising.

Contact: American Legacy Foundation (202) 454-5555, http://www.americanlegacy.org.

Freelance writer Michael Anft contributed to this report.