Americans owe nearly a trillion dollars in outstanding student loans, according to a 2012 announcement from the Federal Reserve Bank of New York. At more than $900 billion, the accumulated student debt already surpasses the nation’s credit card debt by more than $200 billion, and a significant July 1 interest rate hike on certain federal direct loans will potentially add even more debt to that total.

Although interest rates on subsidized federal direct loans, for which the Department of Education pays the interest while a student remains in school and are based on financial need, increased from 3.4 percent to 6.8 percent, there is a potential silver lining for current college students — the rate hike is not retroactive and doesn’t affect students’ already existing loans.

The increase also brings the interest rate for subsidized loans into line with that of unsubsidized federal direct loans — loans not based on financial need and for which the student is responsible for paying the interest while in school — which have stood at 6.8 percent since 2006.

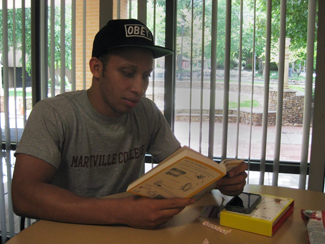

Chris Strickland, who studies communication at Atlanta’s Ogelthorpe University, said that the interest rate increase impacts his personal finances dramatically.

“A lot of my income comes from loans,” he said. “I don’t receive any kind of financial assistance from my mother of my father, because they can’t give it.”

The higher interest rate has left Strickland, who has taken out both subsidized and unstudied student loans, unsure if he will take out any future loans, he said.

“I’m not entirely sure when I’m supposed to pay back my debt,” Strickland said. “I’m going to [law] school after school, so it’s going to be awhile before I have a stable job to be able to pay back my debt.”

He believes politicians, instead of increasing student loan interest rates, should place a greater emphasis on beefing up college assistance programs — especially financial needs-based grants.

“Politicians need to look more in the avenue of getting students off loans,” he said. “I think we have to move off loans [and] increase giving student grants, or increase scholarships opportunities, especially for minorities.”

“And not just racial minorities,“ he added, “but class minorities.”

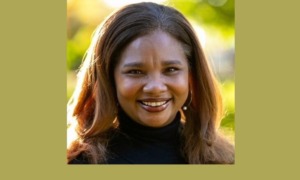

The financial predicament facing student Ellen Eldridge, 34, mirrors the troubles of many college students across the United States.

After obtaining a bachelor’s degree in psychology in 2009, Eldridge took out loans for a handful of MBA classes at on online university. Shortly thereafter, however, she decided to switch majors and pursue a second undergraduate degree in communication at metro Atlanta’s Kennesaw State University.

Today, she finds herself staring down a mountain of student loan debt, the accumulated result of loans to pay for her first bachelor’s degree, her grad school classes and her current slate of undergraduate courses.

“I have quite a bit of debt,” she said with a labored laugh. “Cumulatively, between the subsidized and unsubsidized [loans], it’s right around $46,000.”

She checked her current financial aid status on her laptop. “And I’m hoping that included everything that I’ve borrowed,” she added.

Despite her fiscal worries, however, Eldridge believes she made the right decision by returning to college, saying the experience and networking opportunities of college somewhat offset the sting of her debt.

“When it comes time for grad school,” she said, “I’ll either significantly pay down my undergraduate debt, and/or have an employer that is willing to help pay.”

And even with the 6.8 interest rate in place, Eldridge believes college remains an absolute necessity worth the ever-increasing costs.

“I do know that investing in this country’s education is the only way that we’re going to continue to be competitive in the global economy,” she said. “It’s bad enough if you have to borrow the money, but to have the opportunity, it’s worth the investment in oneself.”

Photos: top: Chris Strickland, bottom: Ellen Eldridge. All photos credit: James Swift.